The current ratio calculator helps quickly calculate your company’s current ratio. Simply take your most recent balance sheet and enter the current asset and current liability figures in this calculator below.

<iframe src="https://calculatorhub.org/?cff-form=72" style="width:100%;height:100%;"></iframe>

What is Current Ratio, Current Assets & Current Liabilities?

The current ratio is a widely used industry indicator for evaluating a company’s short-term liquidity in relation to available assets and outstanding liabilities. Because short-term liabilities are due within the next year, the current ratio is an important measure of liquidity. This suggests that a corporation only has a limited amount of time to raise the funds to settle these liabilities. Furthermore, the current ratio is a good indicator of a company’s efficiency in managing its working capital.

A current asset is a balance sheet item that is either cash, a cash equivalent, or may be turned into cash within one year. They are frequently used to assess a company’s liquidity. Long-term and capital assets are the two types of current assets.

A current liability is a debt that must be paid within a year. A current asset is used to settle current liabilities, either by creating a new current liability or by using cash. “Short-term liabilities” is another word for current liabilities.

Current Ratio Calculator Use

- To calculate the company’s current ratio, you’ll need to know the company’s current assets and liabilities, which can be found in the financial statement.

- In the above calculator, enter the values of current assets and current liabilities in the appropriate fields.

- The calculator will calculate the company’s current ratio based on the data provided.

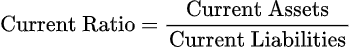

Current Ratio Formula

The formula for calculating the company’s current ratio is easy. You only need the two figures (current assets and current liabilities) from the company’s most recent financial statement’s balance sheet.

What is Good Current Ratio?

A good current ratio is anything greater than 1, with 1.5 to 2 being desirable. A current ratio of 1.5 to 2 indicates that a company or corporation has more than enough cash to satisfy its liabilities while maximising capital efficiency.

A very low current ratio is similarly undesirable, as is a very high current ratio for the company. In any case, there is no clear boundary between what constitutes a good or bad current ratio because companies within different industry groupings will have varying requirements for current ratios.

This is why, rather than treating all companies the same, it’s crucial to compare a company’s current ratio to its industry peers.